What is a CO2-price?

The CO₂ price is the amount companies pay for the right to emit one ton of CO₂. It’s a market mechanism within the European Emissions Trading System (EU ETS) designed to financially incentivize companies to reduce emissions. The higher the price, the greater the incentive to reduce emissions via energy efficiency, electrification, or renewable energy.

The CO₂ price is influenced by several factors:

Supply and Demand

Demand increases with higher economic activity and CO₂ emissions. A shift to coal-fired power stations when gas or renewable production is low also increases demand for emission allowances. A more limited supply leads to higher demand and generally to an increase in the price of CO₂. Supply is determined by the auction volume of EUAs and the MSR (Market Stability Reserve), which absorbs or releases surplus allowances in the event of shortages.

Weather

Cold winters and hot summers increase electricity demand. If renewables fall short, more fossil generation is used, raising EUA demand.

Market Sentiment

Investors like banks and funds buy EUAs as an asset. Like other commodities, market moods can sway CO₂ price trends.

Policy

Policies such as the EU’s “Fit for 55” program (which aims for a 55% emission reduction by 2030) reduce available rights yearly, pushing prices higher.

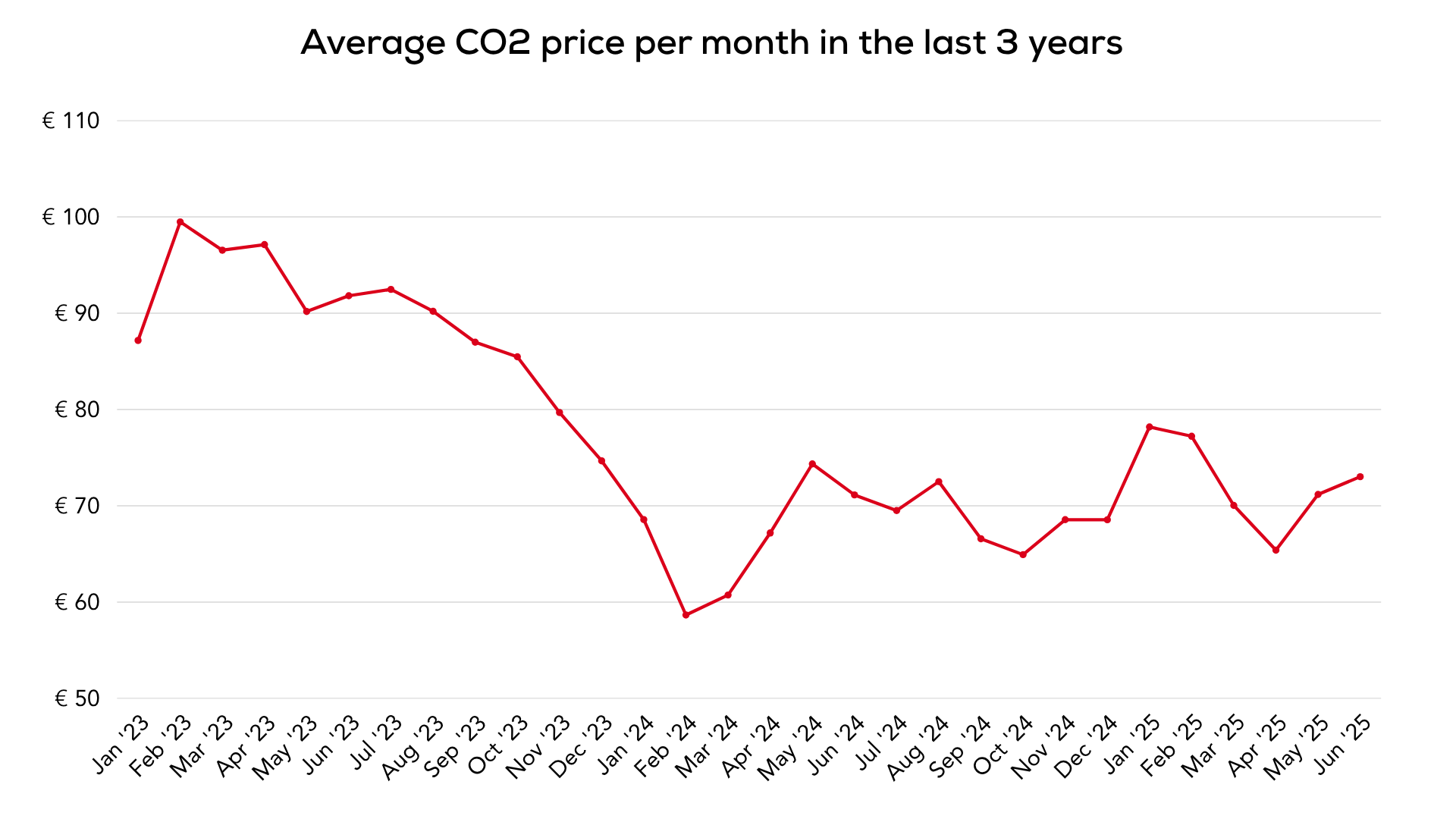

Price development

The Russian invasion of Ukraine in 2022 led to energy insecurity and increased coal plant usage, temporarily pushing the CO₂ price upward. Simultaneously, the EU strengthened its climate ambitions through the Fit-for-55 package, tightening emission caps and accelerating the Linear Reduction Factor, which had a lasting upward impact. During 2023-2024, economic and industrial demand uncertainties in Europe applied downward pressure. On the other hand, structural scarcity (via Fit-for-55) and ETS expansions (e.g., inclusion of maritime sector) again exerted upward pressure. In short, CO₂ prices today are shaped by the tension between structurally tighter policy and short-term supply-demand shocks in energy and economic markets.

Want to get started right away with energy efficiency, electrification or purchasing sustainable energy?

Receive more informationEU ETS

CO₂ emission rights are traded via the EU Emissions Trading System (EU ETS). Each year, a fixed number of allowances (EUAs) are auctioned, under a decreasing emission cap. At year-end, companies must surrender enough EUAs to cover their total CO₂ emissions, typically by April of the following year. Companies can also trade EUAs with each other, enabling cost-efficient reductions where it's cheapest to cut emissions.

The ETS-1 system covers:

- Power Generation: Coal plants, CCGT/STEG gas plants, biomass plants, waste incinerators.

- Energy-Intensive Industry: Iron and steel, refineries, cement, lime and ceramics, chemical, paper, and glass industries.

- Aviation: All flights within the European Economic Area (EEA) since 2012.

- Shipping: Since 2024, maritime voyages between EU ports are also included

Free Emission Allowances

Some sectors don’t have to purchase all their allowances. The EU issues free emission rights to avoid carbon leakage — the risk that production moves outside the EU to avoid carbon costs, undermining emission reductions. These free allowances are based on a benchmark per unit of production (e.g., per ton of steel or cement). Power plants do not receive free rights, as they can pass costs on to electricity prices. Note: The amount of free rights decreases each year, pushing companies to either reduce emissions or buy more EUAs.

Fit For 55

The EU's Fit for 55 package is an ambitious and powerful step towards a more sustainable future. With this package, the European Union aims to reduce CO₂ emissions by at least 55% by 2030 compared to 1990, as an important milestone on the road to full climate neutrality by 2050. Fit for 55 includes measures that directly affect businesses, such as a stricter emissions trading system (ETS), a carbon border adjustment mechanism (CBAM) to ensure fair competition for European companies, higher renewable energy targets and stricter energy efficiency requirements. It also accelerates the transition to zero-emission mobility by phasing out fuel cars. The Fit-for-55 initiative not only compels companies to become more sustainable, but also offers enormous opportunities for growth, innovation and a stronger sustainable competitive advantage.

Incentive for climate-neutral business

The rising price of CO₂ makes sustainable energy not only necessary, but also financially attractive. As fossil-based electricity becomes more expensive, you as an entrepreneur benefit from lower costs and fewer long-term risks when you choose green energy. In this way, sustainability not only strengthens your competitive position, but also your future-proofing vis-à-vis customers and chain partners who are increasingly demanding climate-neutral products.

Together, we accelerate your journey to climate-neutral business.

Would you like to know how your company can respond intelligently to the CO₂ price and start using sustainable energy?